Sacramento Association of Health Underwriters (SAHU) Announces 2023-24 Board Members

The Sacramento Association of Health Underwriters (SAHU) is proud to announce its esteemed board members for the 2023-24 term, showcasing a diverse and dedicated group of professionals committed to advancing the goals and mission of the organization.

Board Members and their Roles:

Helen Ornellas

President

David Brabender

President-Elect

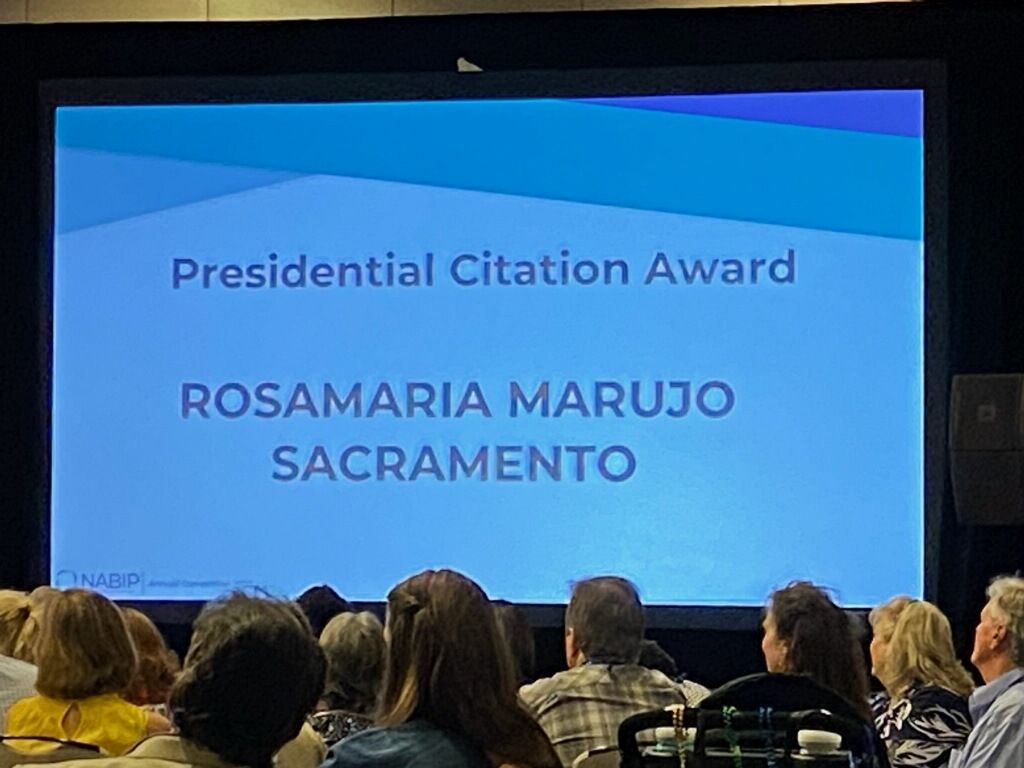

Rosamaria Marrujo

Past-President

Jacqueline Martinez

Treasurer

Lauren Bayha

Executive Director

Michele Mills

Secretary

Michele Meder

Awards Chair

Tamara Moreau

Carrier Relations

Brad Wright

Legislation Co-Chair

Telly Tasakos

Membership Retention Chair

Adam Aguilar

Professional Development Chair

Cerrina Jensen

Political Action Committee Chair

Andrew Garnett

Community Services Chair

Kyle Frantz

Communications Chair

Antonette Vanasek

Media Relations Chair

Dave Fear Jr.

Legislative Co-Chair

Danny Langarica

Vanguard Chair

Angie Caruso

New Membership Chair

Andy Glenn

Programs Chair

Renée Balcom

Diversity, Equity, and Inclusion Chair

Dalia Sutton

Medicare Chair

Our Mission and Vision for the 2023-2024 Term

President Helen Ornellas shares her vision for the year, stating, “Our mission in 2023-2024 is mentorship and leadership. SAHU is looking for those who would like to make a difference in our chapter, in the industry, and their careers. We have started the Past Presidential Advisory Committee to provide insight, one on one mentorship, and guidance for those who are interested in leadership at the Chapter Level, State Level and National. Or lets us know how we can help you; we have the tools and people! 35 Years strong.”

SAHU Board Nominations

Joining the SAHU board can provide a wide range of benefits for both personal and professional growth. By becoming a board member, you can expand your network and connect with other industry professionals. Additionally, you can have a direct impact on the strategic direction and decision-making processes of the association. Serving on the board can also enhance your leadership and teamwork skills, as you work collaboratively with other members to achieve common goals. It’s an opportunity to give back to the community and make a positive impact on the industry, while also gaining valuable experience and building your resume.

Perhaps you or someone with whom you have served has the vision and the passion, both for the association and for the industry as a whole, to help lead SAHU in the coming years.

To nominate a deserving candidate or even yourself, please visit https://cahip-norcal.org/sahu-officers-nomination-form/. The deadline for nominations is April 15, 2024.

Let us work together to build a stronger, more vibrant SAHU community.

2023-2024 SAHU Board Members Induction

###

For over 30 years, SAHU has worked to improve our members’ ability to meet the health, financial and retirement security needs of all Californians and Americans through education, advocacy, and professional development. For more information, please visit: sahu-ca.com.

.png)

.jpg)

.jpg)