SAHU’s 2023 Business & Medicare Expo: A Resounding Success!

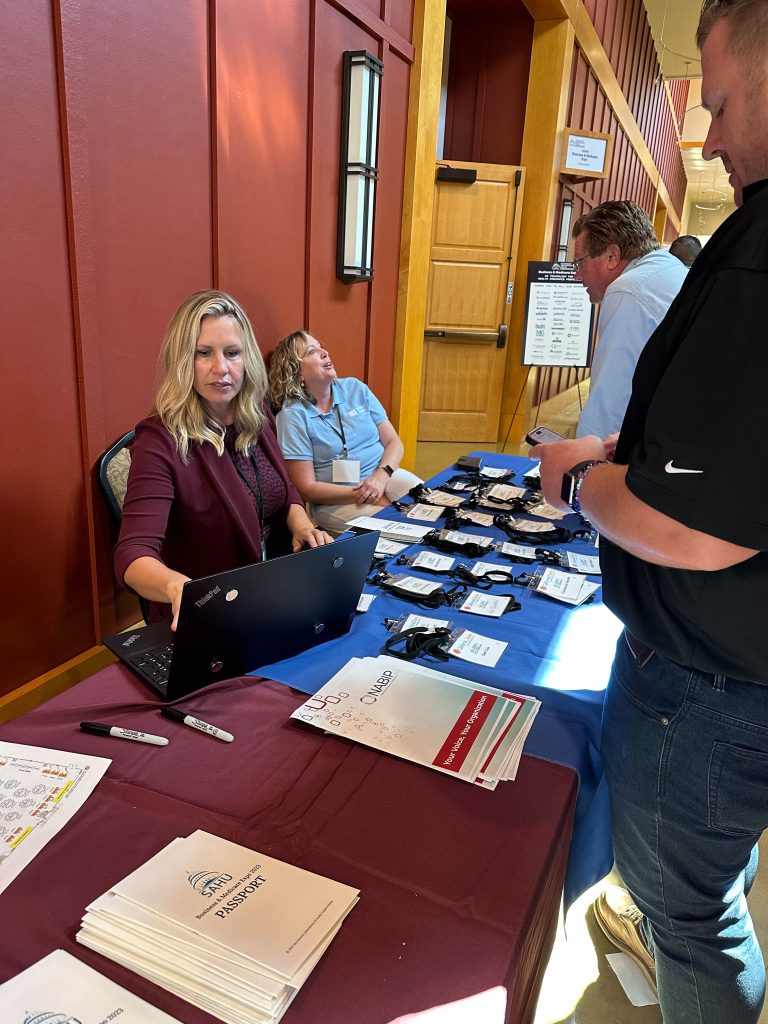

The Sacramento Association of Health Underwriters (SAHU) proudly looks back on its 2023 Business & Medicare Expo as an unprecedented success. The AI Technology themed event garnered a remarkable turnout of over 300 registrants, reflecting the growing interest and commitment of professionals in the insurance industry. A highlight of the event was the Medicare Breakout session, which was met with an overflowing audience, emphasizing its significance in today’s healthcare landscape. In line with SAHU’s dedication to professional development, the Expo offered 5 CE courses that provided valuable insights and knowledge enhancement for attendees.

SAHU also proudly announced the exceptional individuals who will be joining the SAHU board for the 2023-2024 term. This esteemed group of professionals brings their expertise and dedication to further enhance our organization’s mission, ensuring a bright future for SAHU.

The vibrant atmosphere was complemented by the presence of 30+ exhibitors who showcased the latest trends, products, and services in the industry.

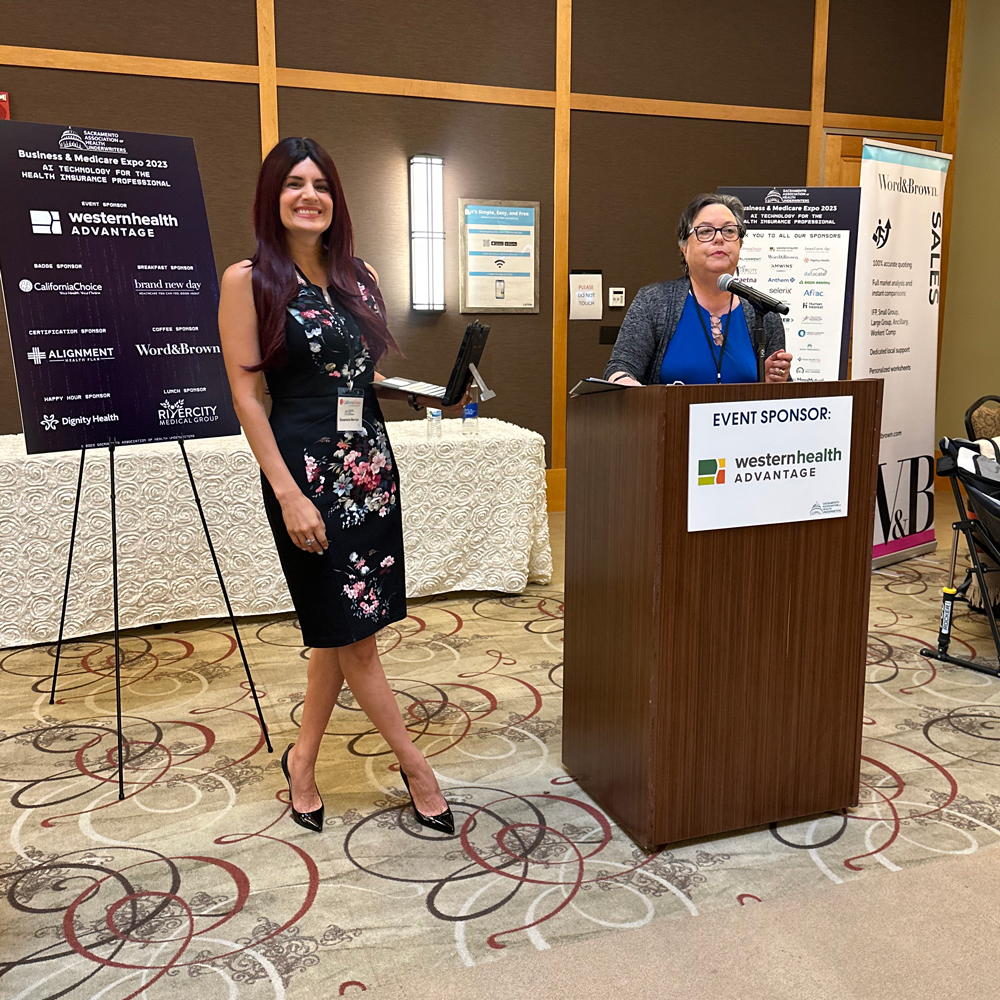

Our fantastic Keynote speaker, Ryan Howard, Corporate Executive with AnalytIQ Advisors, left our audience inspired with his insights on empowering insurance sales agents through the strategic utilization of AI tools for enhanced customer engagement and substantial revenue growth. We also had the privilege of welcoming Tim Kanter, President of California Association of Health Insurance Professionals (CAHIP), who delivered a powerful and informative legislative update, keeping our attendees well-informed on the latest industry developments. We extend our heartfelt thanks to Ryan Howard and Tim Kanter for their invaluable contributions, which enriched the Expo experience for all.

We owe a great deal of gratitude to our sponsors, each of whom played a pivotal role in making the Expo an unparalleled experience! A big shout out to Brand New Day for ensuring our attendees started their day with a nourishing breakfast, and River City Medical Group for curating an exquisite lunch. The event was energized with coffee breaks sponsored by Word & Brown, while Dignity Health brought everyone together with an enjoyable Happy Hour. Recognition is also due to California Choice for their badge sponsorship, and Alignment Health Plans for taking on the mantle of Certification Sponsor.

Finally, we extend our profound appreciation to Western Health Advantage for championing this event as our main sponsor. Their unwavering support made it possible for SAHU to elevate the Business & Medicare Expo to new heights.

We look forward to future collaborations and even more successful events!

###

For over 30 years, SAHU has worked to improve our members’ ability to meet the health, financial and retirement security needs of all Californians and Americans through education, advocacy, and professional development. For more information, please visit: sahu-ca.com.

.png)

.jpg)

.png)

.jpg)

.png)